A well-established FX broker in Europe upgraded to a safer Forex Turnkey Solutions: How to Launch and Scale a Brokerage in Weeks foreign exchange CRM software program, which led to a 70% reduction in cyber threats as a outcome of enhanced encryption and automated safety audits. A safe CRM ensures that shopper data remains protected and builds trust between the dealer and its traders. Without a well-structured IB management system within forex CRM software program, brokers risk dropping valuable partners because of inefficiencies. For instance, a large-scale FX trade dealer in Australia improved its IB retention price by 20% after implementing forex CRM software that allowed IBs to track commissions in real-time.

Apac Car Telematics Trade Decade Long Developments, Evaluation And Forecast 2026-2034

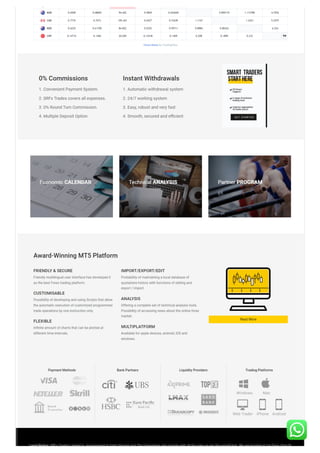

One such essential device for Forex brokers is a Finest Forex CRM Supplier in Dubai. In this information, we will explore what a Foreign Exchange CRM is, why it is important, and how to choose on the best Foreign Exchange CRM provider 2025 for your corporation. Our CRM is not only a database—it’s a whole automation engine designed particularly for forex and crypto brokerages.

The transformative energy of our Forex CRM becomes clearest when analyzing real-world implementations. Contemplate the case of a mid-sized brokerage battling manual processes and inconsistent follow-up. Earlier Than implementing our answer, their sales team wasted numerous hours on administrative duties while missing important alternatives to engage potential purchasers. This complete method to cost administration saves numerous hours while minimizing financial risks.

- First, assess how properly potential options integrate with your present technology stack, notably your trading platform and payment processors.

- Finally, the extraordinary competition amongst distributors makes it challenging to determine a sustainable competitive benefit.

- Forex CRM systems are specialised buyer relationship administration tools designed exclusively for Foreign Exchange brokers.

- The best Foreign Exchange CRMs supply more than just shopper administration — they provide highly effective instruments for optimizing operations, enhancing client engagement, and driving enterprise progress.

- Sure — you probably can configure deposit bonuses, rebate campaigns, and performance-based incentives immediately in the Forex CRM, with automated tracking and reporting.

If a trading platform is integrated with the CRM seamlessly, there could be a smooth circulate of information from CRM to buying and selling accounts and vice versa. There must be a hassle-free conversion funnel the place brokers can track and nurture potential leads. Whether it is capturing the leads, categorizing them, or following up with automation, the CRM must be ready to assist the broker and his gross sales group. In addition, it’s predictable that some CRMs will include buying and selling engine linking capabilities for processors immediately.

Introducing Dealer (ib) System

In today’s aggressive market, having the right Buyer Relationship Management (CRM) system isn’t just a nice-to-have—it’s essential for survival and development. Given tightening laws in international FX markets, compliance readiness is no longer elective — it’s necessary. This minimizes your legal and operational risk, providing you with peace of thoughts and defending your popularity. Such integration is broadly considered a core requirement for any severe Foreign Exchange CRM.

The platform mechanically tracks each facet of partner performance, from shopper acquisition to buying and selling quantity, applying complex commission constructions with perfect accuracy. Customizable dashboards give each brokers and their partners real-time visibility into efficiency metrics, fostering transparency and belief in these critical relationships. Compliance features have turn out to be non-negotiable in today’s regulatory environment. These features not only ensure regulatory compliance but also significantly cut back the chance of fraudulent activity. Forex CRM software program is a back-end device that additionally enables the growth of your brokerage.

Danger Management Instruments

The forex and CFD trade has undergone significant evolution in the past few years. Buying And Selling volumes are rising, regulation is tightening, and shopper expectations have shifted towards pace, transparency, and seamless digital experiences. A sturdy Forex CRM captures, tracks, and nurtures leads from multiple sources — web sites, campaigns, and referrals. Centralized client profiles streamline shopper tracking, communication, and conversion. Consider the CRM provider’s help companies and training choices to make sure easy implementation, ongoing upkeep, and workers proficiency in utilizing the system successfully. Contemplate a CRM with robust cellular capabilities, enabling Brokers and traders and workers to entry essential knowledge and functionalities on-the-go, enhancing responsiveness and consumer engagement.

Work With Shoppers

By adopting a CRM system, you’ll be in a position to streamline your operations, automate your administrative tasks, and supply personalised options that meet your customers’ wants. The overseas exchange market, commonly known as forex, is a complex and dynamic trade that requires a excessive stage of attention to element and customer service. With the growing competitors in this sector, businesses need to undertake modern technological solutions to reinforce their operations and maintain a competitive edge. One such tool that’s becoming increasingly in style in the foreign exchange industry is customer relationship management (CRM) software. Having labored within the monetary providers market for an extended time, we do perceive that for Foreign Exchange brokers, time is money.

Contact us at present and uncover how our know-how can transform your fx trade dealer business. A startup FX commerce broker that initially operated in a single area successfully expanded into three new markets by adopting a extremely customizable foreign exchange CRM software program. The capability to tailor CRM features is crucial for rising brokerages looking to expand into new markets. A North American FX broker integrated AI analytics into its foreign exchange CRM software program, identifying shoppers susceptible to churn. By launching a targeted retention marketing campaign, they lowered churn by 15% within six months. Predictive analytics in forex CRM software enable brokers to anticipate challenges and take proactive measures.